Have you ever thought of a better solution to resolve your bad credit report and satisfy your craving for a new credit card? Then the Blaze credit card is the best option for you. Your approval depends on your bad credit history with this card.

Blaze Credit is an unsecured card that establishes someone’s credibility without a deposit (you don’t need any money in your account until approved). The Blaze credit card is a MasterCard that can be accepted anywhere for purchases. This card can help you increase your credit score to qualify for premium cards. You can read the Blaze Credit Card Reviews before applying for the same.

Or

In addition, the company allows its consumers to sign up online for easy access to its services. As a Blaze card cardholder, you have no hidden fees. However, some unsecured credit cards charge exorbitant fees to make the most of the cardholder role. Interestingly, the cardholders of Blaze receive positive reviews for providing friendly service to their customers.

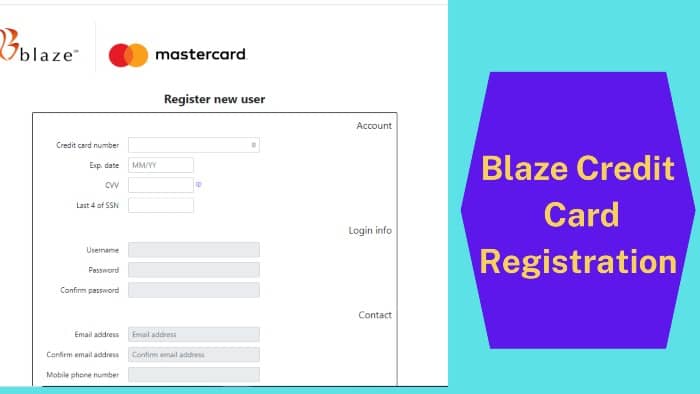

How To Register For Blaze MasterCard Credit Card?

Many customers read Blaze MasterCard Reviews before signing up. Here is how you can apply for the Blaze Card after reading the Blaze MasterCard Reviews. Please read them carefully when registering.

- Visit the Blaze Credit Card website to register.

- In this case, it will take you to the Blaze Card homepage if you go to the above website.

- Scroll down the homepage, and you will see the “Account Login” button in the lower right corner of the Blaze Credit homepage. Click the green Connect to account button.

- After clicking Account Login, the website will take you to the Blaze credit card login page.

- On the Blaze card registration page, click the Register New User link.

- Enter your Blaze card registration credentials below:

- Credit card number

- Card expiration date

- CVV

- The last 4 of your SSN

- Email address

- Phone number

- After entering the above credentials, create your username and password and confirm your password.

- Then confirm your email address.

- If you don’t want your mobile number to appear on your Blaze card account, check the box next to the word “I prefer not to add my mobile number.”

- Please read the terms and conditions on the Registration Portal. After that, check the box that appears on the word “I have read and accept the terms.”

- Finally, click on the “Register” button.

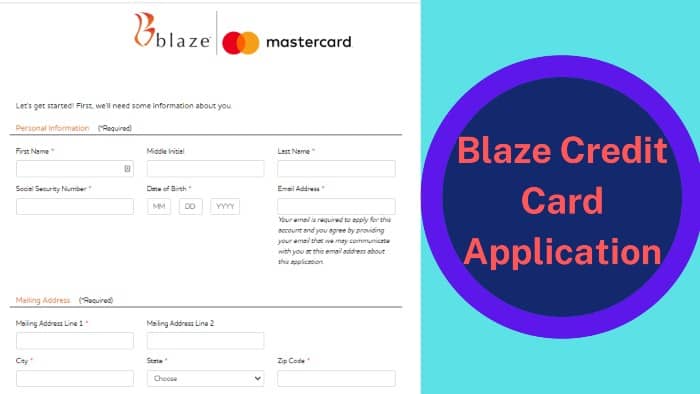

Procedure To Apply At www.blazecc.com

Find out how to apply for a Blaze credit card online.

- Visit the Blaze Credit Card Portal at www.blazecc.com with your web browser.

- Tap the “Apply Now” button, and the apps panel will open.

- Enter your name, CPF, date of birth, and email address in the appropriate fields.

- In addition to the addressee’s name, you must enter the city, state, and zip code in the appropriate fields.

- Add your phone number and your mother’s maiden name.

- Enter the information you see on the Financial Information tab.

- Enroll for optional benefits and click “Preview Your Application.”

- Please read your application carefully before submitting it.

- Then click on the submit tab to complete the application process.

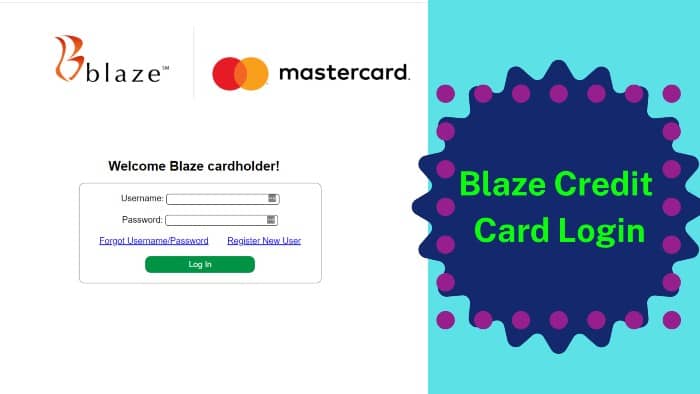

Guide To Perform BlazeCC Login

After registration, the next step is to proceed with the Blaze Credit Card Login. You must first apply for the Blaze credit card or register to participate. To go for BlazeCC Login:

- Visit the BlazeCC website to access Blaze CC (www.blazecc.com).

- If you access the above website, you will go to the Blaze Credit Card homepage.

- Scroll down the homepage, and you will see the “Account Login” button in the lower right corner of the Blaze Credit homepage. Click the green Connect to account button.

- After clicking Account Login, the website will take you to the Blaze credit card login page.

- At the Blaze credit card login portal, enter your username and password.

- After entering your Blaze CC credentials, click the Sign In button.

- The website will give you access to your BlazeCC Login Account.

Requirements For Blaze MasterCard Login

The Blaze MasterCard login requirements are as follows:

- To log in with BlazeCC, you need your username and password.

- You should visit the website (www.blazecc.com).

- You can connect with electronic devices such as smartphones, tablets, iPads, PCs, and laptops.

- You need to log in using different browsers such as Opera, Microsoft Internet Explorer, Mozilla Firefox, Google Chrome, and Apple Safari.

- Your region must have a good internet connection to access the BlazeCC link.

Reset Your Blaze MasterCard Login Username Or Password

When registering for a Credit Card of the Blaze brand, your website will provide you with your BlazeCC Login username and password. Many cardholders sometimes forget their username or password to log into their Blaze credit card account. Follow these steps to reset your username or password:

- Visit the Blaze Credit Card website (www.blazecc.com).

- You will pass through to the Blaze Credit Card homepage if you access the above website.

- Scroll down the homepage, and you will see the “Account Login” button in the lower right corner of the Blaze Credit homepage. Click the green Connect to account button.

- Click the Forgot username/password link on the Blaze MasterCard login page.

- Click the “Next” button after reading the sentence “If you have forgotten your username or password, you must complete the security verification process.”

- Please enter your login details below and click “Next.”

- Blaze Credit Card Account Number

- Expiration Date

- You will need the three-digit security code (tucked into the back of the card)

- The last four digits of your SSN

- After entering your old credentials, follow the remaining steps and click Next to reset your credentials.

Blaze Credit Payment Options

To pay your Blaze credit bills, you have the following options:

Using Online Account: To pay your current fees, log in to your online account management page and navigate to the payment section of the page to pay your current fees.

Via Phone Number: You can pay your credit card charges over the phone by calling your bank. If you pay by debit card, you will have to pay a small fee.

Through MoneyGram: If you use MoneyGram to pay your Blaze card bills, you must use code 5879.

Through Western Union: Enter the “Blaze/SD” code if paying via Western Union during checkout.

Via Regular Mail: You can send your payments by check/money order to the address below. Please add your credit card number to your payment before submitting it.

Blaze Mastercard

PO Box 2534

Omaha, NE 68103-2534

Benefits For Blaze Cardholders

Take Approval

It is easy to get approved, and you must apply online. Once the request is verified, you will receive approval. You will receive a Blaze credit card in your name. You can quickly check Blaze credit card reviews from users who got their acceptance within a few months.

No Hidden Fees

Once approved, only one fee will appear on your statement, an annual fee of $75. You will receive all the details of this statement upon receipt of your card. This card pays a yearly low-interest rate (yearly fee), usually 28%. Compared to other premium cards, it is deficient.

Functional Credit Card

Credit cards are now necessary for almost every situation and make life short of cash. Several conditions exist, such as Online shopping (mainly used for discounts), hotel reservations, car or house rental, etc. A Blaze card works great anywhere, so there’s no need to worry.

Financing Speciality

In some cases, the APR will be as high as 29.50%. You don’t have to worry because the company already claims that the APR will not increase in case of non-payment. I think it’s great news. Mainly some other markets and financial institutions increase the APR. For example, when you make a late payment. But the growing number is not huge. It is a little that does not pose a problem.

| Official Site | Blaze Credit Card |

|---|---|

| Portal Type | Login |

| Application Required | Yes |

| Country | United States of America |

| Managed By | First Savings Bank |

Customer Service Centre

First Savings Bank is setting up a customer service center for Blaze credit cardholders to resolve their queries and complaints. Blaze Credit Card Customer Service Center, with customer service representatives, will be happy to resolve your questions and complaints regarding the same.

You can direct your questions and complaints about your Blaze credit card to our customer service representatives. First Savings Bank Blaze credit card hires a customer service representative to resolve your issue over the phone. We welcome your comments on this policy or our practices. You can contact the Blaze Credit Card Phone Number given: 866-205-8311 to resolve your issues regarding Blaze Card.

Below is a list of mailing addresses that you can use to contact Blaze Credit Card customer service:

Payment Address

Blaze Mastercard

PO Box 2534

Omaha, NE 68103-2534

Correspondence Address

Blaze Mastercard

PO Box 5096

Sioux Falls, SD 57117-5096

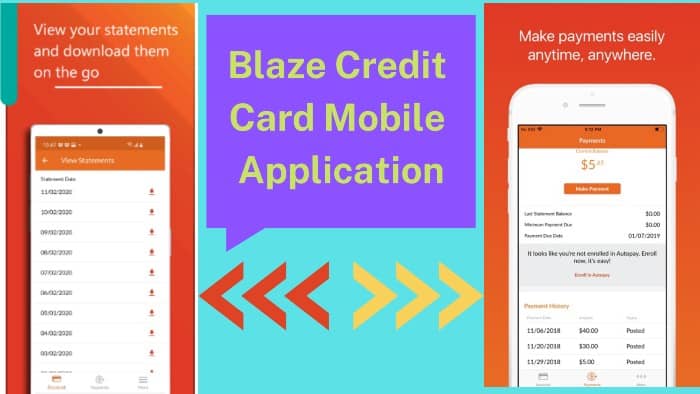

Mobile App For Blaze Card Users

Do you have smartphones in your hands? If yes, fine. The importance of smartphones is that any work becomes quick and easy thanks to the online mode through this device. With the help of your smartphone, you can pay your bills, log into your account, do your registration and application work, do your finances or banking, do your investments and transactions, and much more. It is possible to accomplish these tasks by launching various applications on your smartphone via Google Play (for Android users) and Mac Apple Store (for Apple users).

The Blaze credit card app is available on the Google Play Store and Apple Store. You can download it on your smartphones, laptops, PCs, iPads, and tablets. It has the following properties:

Quick And Easy Account Access (On Supported Devices)

Touch ID® and Face ID® for secure login.

Stay Informed When You’re On The Go.

- Sign up for account notifications and set your notification preferences to monitor your account activity.

- You can set up and manage notifications when your payment is due or reaches us.

Manage Your Blaze Credit Card Account

- Check your balance and available funds and view or download monthly statements.

- View the payment due date and make payments.

- Manage automatic payment by registering, modifying, or canceling.

- Update your account information (address and phone number).

About Blaze Credit Card Financing

Blaze Credit is an unsecured card that establishes someone’s credibility without a deposit (you don’t need any money in your account until approved). The Blaze credit card is a MasterCard that can be accepted anywhere for purchases. It is an unsecured credit card specially designed for people who want to start building their credit profile.

The Blaze Credit Card operates under the MasterCard franchise network. It offers a convenient way to build your bankroll and improve your story. Reviews show that this card provides better terms even after bankruptcy.

This card offers the ability to work on your credit score without paying excessive fees. It is issued by First Savings Bank and managed by Capital Services in South Dakota. If you can’t get a deposit on a secure credit card, this card is better than the high-fee non-secure card options.

Frequently Asked Questions

What Are The Blaze Credit Card Application Requirements?

You must apply for the Blaze Credit Card online to secure the Blaze Credit Card. Log in and provide your personal information. You will save the government money. Get an ID from the government. Other information may include your email address, monthly salary, and physical address.

Does Blaze Credit Credit Card Offer Rewards To Its Customers?

The Blaze credit card does not have built-in rewards. However, you can opt for your Premium Club membership. Membership costs $4.95 per month and offers travel discounts.

Who Can Use The Blaze Mastercard?

The Mastercard of Blaze is available to anyone who:

- I do not want to deposit the Security Deposit amount.

- Have bad credit and enjoy a fresh start.

- Plan to pay your billing balance in full each month.

- Consider your credibility seriously.

Conclusion

Applying for the Blaze credit card is a positive step toward building your credit profile and holding you accountable for using the card. Blaze Credit is a decent alternative if you’re struggling to qualify for other credit cards and don’t want to apply for a secure card. If you’re trying to avoid a high deposit, the card might be worth it.

This page explains how to register and apply for Blaze Credit or MasterCard, the registration process and credential reset, benefits, Blaze credit card payment options, and the mobile app used to use this credit card. Many people read the Blaze Credit Card Reviews before applying for the same.